TexasRenters.com Tenant Selection Criteria

Please take the time to read the qualification guidelines thoroughly and check your credit report in

advance of completing an application, all application fees are non-refundable and every occupant 18 or

older must complete an application whether they will be a financially responsible party or not.

Please take the time to read the qualification guidelines thoroughly and check your credit report in

advance of completing an application, all application fees are non-refundable and every occupant 18 or

older must complete an application whether they will be a financially responsible party or not.

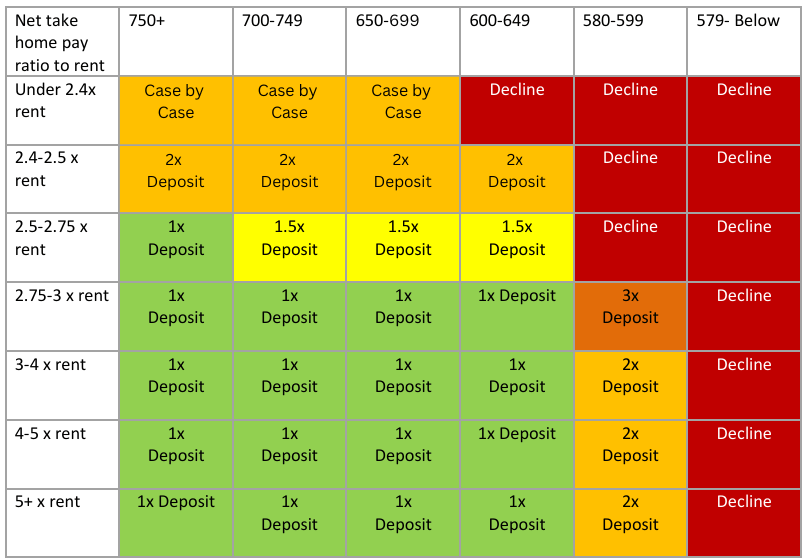

Minimum Credit and income requirements:

Please refer to the chart for the deposit level.

- Candidates must have at least a 600-credit score and net income (take home pay after all

deductions) of at least 2.75 times the monthly rent to qualify with a standard one-month

deposit. - Candidates with net income below the 2.75x threshold may qualify with an increased deposit if

their credit score is 600 or higher, inversely candidates with credit scores under 600 but not less

than 580 may qualify with an increased deposit if their net income ratio to rent is 2.75 times or

higher - Candidates with net income below 2.75x the rent amount and credit below 600 will be declined.

- All applicants must undergo a third-party verification process to confirm both income and

identity.

Animals in residence:

Our pet restrictions vary by listing, and some listings may require final owner approval. All pet deposits

start at $500 and increase for additional pets. Pet deposits are on a case-by-case basis depending on the

breed and age of the animal, and the renter's creditworthiness, and will be determined upon review of a

completed application. Deposits are refundable. We also charge pet rent of $25 per pet per month as an

increase in the monthly rent. We reserve the right to qualify all animals through a third-party screening

service such as www.OurPetPolicy.com which does have an additional fee.

Additional factors resulting denial or increase in security deposit:

In addition to the minimum credit and income requirements listed above we will be checking for the

following adverse information that may disqualify applicants or incur an increased deposit.

Will be declined:

Candidates will be denied for any of the following adverse information sourced from any applicants

screening report.

- False or unverifiable information on their application

- Failure to meet the minimum credit and income requirements listed above

- Any prior evictions, eviction filings, or judgements related to a rental residency including

occupants - Broken leases within 3 years

- Violent Felonies, sex offenses; and/or appearance on any sexual offense or terrorist database

including occupants. - Current bankruptcy

- Collections, past due accounts, or charge offs that exceed one month’s rent

- Failure to provide electronically verifiable bank or employment verification

- Not legally present in the United States including occupants

May be declined:

The following items may result in denial of application or an increase in deposit above the level

indicated on the minimum criteria chart. Deposit increases can range from an additional half month rent

to an additional 3 months of rent and are to be determined based on the severity of the adverse

information sourced from any applicants screening report.

- Collections, past due accounts, or charges offs up to one month of rent (in excess of one month

rent will be declined as outlined above) - Utility bills in collections

- Total debt including proposed rent to income ratio exceeding 50%

- Outstanding balances due to previous landlords

- Auto loan repossessions or other defaulted instalment loans

- Excessive late payments on open or closed lines of credit

- Broken leases over 3 years old

- Foreclosure or short sale within the past 3 years

- Criminal history not listed in the will be declined category will be considered on a case-by-case

basis dependent on the severity, recency, and overall candidate qualifications. - Adverse rental history such as late payments, NSF, failure to give written notice

Other considerations

- Income documentation must be in the form of electronically verifiable paystubs either through

banking or payroll verification for employees or tax returns and electronically verifiable bank

statements for self-employed candidates. Those moving for a new job may provide an accepted

offer letter. All income documentation must be able to be to be verified. We do not accept

paper bank statements or other pretax ledgers for income verification. - Multiple tenants combining income to qualify will be assessed on a weighted average basis. If any applicant

needing to combine income to qualify has credit below 650 an increased deposit will be assessed (amount to be determined by management - We do not allow cosigners; any non-occupying party applying with an occupying party will be

considered a leaseholder, and subject to all guidelines including total debt to income ratio. - Management reserves the right to cure any adverse credit factors with an increase in deposit up

4x the rent